|

Dua warga emas ditipu RM100,000 pelaburan tanam padi di Kemboja |

|

|

|

|

Written by admin3

|

|

Friday, 02 April 2021 15:07 |

|

April 2, 2021 10:50 MYT April 2, 2021 10:50 MYT

KUANTAN: Dua wanita warga emas mendakwa kerugian RM50,000 setiap seorang selepas diperdayakan untuk menyertai pelaburan menanam padi di Kemboja, yang disertai mereka sejak tujuh tahun lepas.

Ketua Jabatan Siasatan Jenayah Komersial Pahang Supt Mohd Wazir Mohd Yusof berkata mangsa yang berusia 75 dan 65 tahun mendakwa tertarik untuk melabur selepas menyertai jelajah kononnya dibuat sebuah syarikat pelaburan di sebuah hotel terkemuka di sini, sekitar Jun 2014.

"Pada program jelajah itu, mangsa mendakwa mereka dijanjikan pulangan sebanyak RM52,000 setiap tiga bulan untuk tempoh tiga tahun jika mengambil satu lot padi bernilai RM50,000.

"Mangsa mendakwa mereka menandatangani surat perjanjian sekitar Ogos 2014 selepas membuat bayaran RM50,000 melalui cek yang diserahkan kepada seorang ejen syarikat tersebut," katanya dalam kenyataan di sini, hari ini.

Mohd Wazir berkata, bagaimanapun kedua-dua mangsa mendakwa tidak pernah menerima pulangan yang dijanjikan sehingga tahun ini, selain gagal untuk menghubungi ejen syarikat itu menyebabkan mereka berasa ditipu.

|

|

Last Updated on Friday, 02 April 2021 15:08 |

|

Read more...

|

|

|

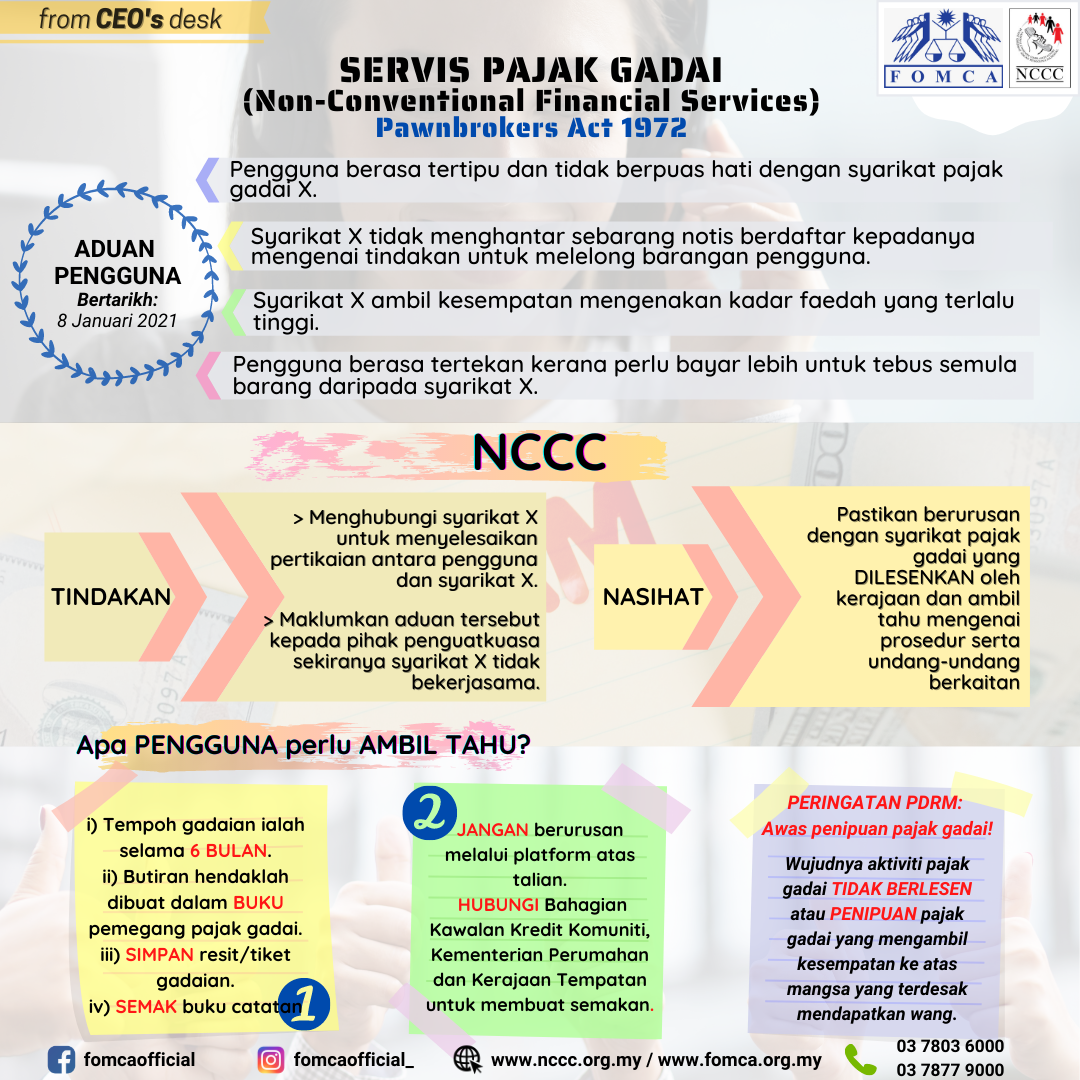

Aduan Pengguna: Servis Pajak Gadai |

|

|

|

|

Written by admin3

|

|

Friday, 02 April 2021 14:21 |

|

FOLLOW US ON OUR SOCIAL MEDIA TO GET A CLEARER INFOGRAPHIC:

> Facebook Page: fomcaofficial

> Instagram: fomcaofficial_ |

|

Last Updated on Friday, 02 April 2021 14:37 |

|

Consumers left in unfavourable position |

|

|

|

|

Written by admin3

|

|

Thursday, 01 April 2021 10:55 |

|

1 April 2021 1 April 2021

THE Consumer Claims Tribunal and Tribunal for Homebuyer Claims do not allow the disputing parties to be represented by practising lawyers. This is because they are supposed to be low-cost forums for the public’s small claims matters.

In many cases, this provision leaves the claimants at a great disadvantage as large businesses often have employees who have legal qualifications. These employees, who are not holding practising certificates from the Bar Council, are assigned to represent their employers at tribunal hearings. For all practical purposes, they are “lawyers” but are allowed to speak for their employers.

The man in the street can get the help of anyone (including lawyers) to prepare their claim forms for filing. But at the hearing, they may have difficulty presenting their cases. They may not be articulate enough or coherent in their presentation, and may not be able to rebut what the defendants’ “lawyers” are saying.

Thus, some claimants are left in a very disadvantageous position at the hearings not because they have any physical “disability”, but because their knowledge, experience, confidence and ability to articulate their thoughts are no match for the defendants’ “lawyers”.

A clause in the laws of the tribunals says: “a minor or any other person under a disability may be represented by his next friend or guardian ad litem”.

Is a layperson claimant who is facing a “lawyer” from the defendant’s side “under a disability” as he is no match for the “lawyer”? How is this section interpreted and applied by the tribunals?

|

|

Read more...

|

|

|

Written by admin3

|

|

Friday, 02 April 2021 14:16 |

|

April 1, 2021 @ 5:17pm April 1, 2021 @ 5:17pm

LETTER: The Federation of Malaysian Consumers Associations (Fomca) and the National Consumer Complaints Centre (NCCC) would like to alert Malaysian consumers on sudden spike of scams related complaints and be cautious and remain alert to scams.

Scammers are becoming increasingly more sophisticated with their tactics and are hoping that you let your guard down. We urge consumers not to provide their personal, banking or any details to strangers who have approached them though phone calls.

Fomca been receiving approximately 450 complaints and enquiries related to scam since January 2021. Based on our observation, these scammers take advantage of the vulnerable consumers and surprisingly some of the victims are highly educated.

It is becoming more difficult to know and differentiate between a scam and a legitimate business. Fomca also would like to urge all relevant authorities to be more active and play their role in curbing these unscrupulous activities.

Many consumers are still not aware about scamming activities. The Communications and Multimedia Ministry and the Malaysian Communications and Multimedia Commission (MCMC) should play an important role to educate consumers by using their channels to reach out to the public at large.

The Domestic Trade and Consumer Affairs Ministry also need to publish and update frequently all scam related cases in their website so that consumers would be able to get information relating to scams. Enforcement agencies also must charge these culprits and increase fines and jail terms for these offences.

Scammers are constantly trying to steal consumers' personal data using fake emails, websites, phone calls, and even text messages. They use a variety of ways to try to trick people into providing personal information, bank account numbers, and other valuable information such as credit card numbers.

|

|

Read more...

|

|

SC probes rings that cheated investors of RM7mil |

|

|

|

|

Written by admin3

|

|

Thursday, 01 April 2021 10:39 |

|

1 April 2021 1 April 2021

PETALING JAYA: The Securities Commission Malaysia (SC) is investigating a syndicate suspected of running unlicensed investment schemes promising high returns to prospective investors.

In a statement today, the SC said the syndicate was being investigated for alleged offences under the Capital Markets and Services Act 2007.

It said SC officers raided several of the syndicate’s locations in Kuala Lumpur recently, confiscating their records and devices. Their servers were also shut down.

According to the statement, the syndicate, which also runs two clone firm schemes promising high returns in a short period of time, was believed to have duped hundreds of investors of over RM7 million.

Initial investigations show that the syndicate had been operating the unlicensed schemes since 2016.

SC identified these schemes as:

|

|

Read more...

|

|

|

|

|

|

|

Page 12 of 18 |